Renters Insurance in and around Cupertino

Renters of Cupertino, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Calling All Cupertino Renters!

No matter what you're considering as you rent a home - utilities, price, number of bathrooms, house or apartment - getting the right insurance can be valuable in the event of the unanticipated.

Renters of Cupertino, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Why Renters In Cupertino Choose State Farm

When the unexpected abrupt water damage happens to your rented space or property, generally it affects your personal belongings, such as a set of favorite books, a video game system or a bicycle. That's where your renters insurance comes in. State Farm agent Gurbinder Mavi is dedicated to help you examine your needs so that you can keep your things safe.

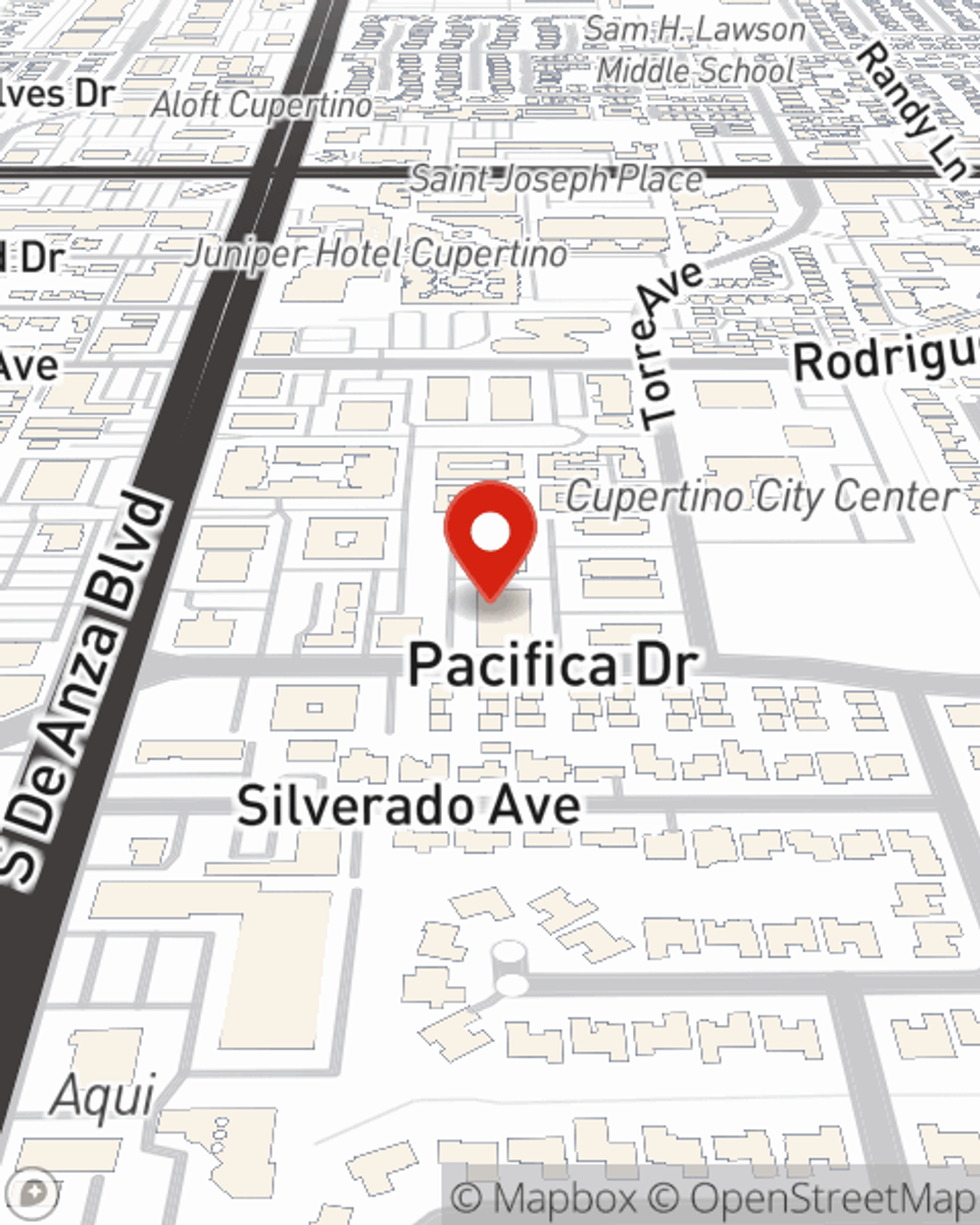

Renters of Cupertino, State Farm is here for all your insurance needs. Visit agent Gurbinder Mavi's office to learn more about choosing the right policy for your rented property.

Have More Questions About Renters Insurance?

Call Gurbinder at (650) 237-0400 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.

Gurbinder Mavi

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.